All About Opening Offshore Bank Account

Table of ContentsThe Greatest Guide To Opening Offshore Bank AccountSome Known Details About Opening Offshore Bank Account The Definitive Guide for Opening Offshore Bank AccountOpening Offshore Bank Account Fundamentals ExplainedHow Opening Offshore Bank Account can Save You Time, Stress, and Money.The Definitive Guide to Opening Offshore Bank Account

Pick your currency. Opening up an account in a different nation will typically mean that you need to utilize a different money to hold, deposit and also withdraw your funds than you would certainly in your domestic nation. If you obtain revenue or settlements in a foreign currency, it can be convenient to make use of a bank that runs with that currency.

Prior to you open up an account, do detailed study into the financial institution and what's anticipated of you as a client.

Fascination About Opening Offshore Bank Account

Whether you're emigrating, are already there or have financial interest worldwide, we'll assist you handle your money.

There's an assumption regarding offshore accounts that lots of people see them as just for savvyand probably shadybusinesspeople as well as accountants. The reality is that anybody can lawfully open an overseas account in an issue of hours with a little research study as well as resolution. This post resolves some myths about overseas accounts by telling you what they really are and also exactly how you can open up one, if you 'd like to.

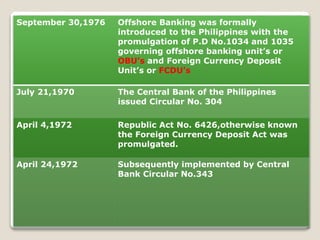

Table of contents The simple meaning of overseas financial is that it is banking done outside your home country - opening offshore bank account. The term incorporates business and people who invest and also associate with worldwide financial institutions. Over the previous half a century, Switzerland and also the British territories of Bermuda as well as the Cayman Islands became popular hubs for offshore financial.

What Does Opening Offshore Bank Account Mean?

As stated, lots of people have a perception that overseas financial is only for the rich, accountants, or affluent offenders. But while those groups may utilize them, overseas financial itself is not an unlawful task if you don't utilize one as suchlike for tax obligation evasion or money laundering. It's legal to place your cash in countries that have various financial systemsif you follow the policies as well as policies of the foreign and also United States governments.

There's no regulation that stops United States residents from opening up an offshore financial institution account. If you mean to open an offshore account, it's crucial to be mindful of the tax implications connected with the accountboth coverage and also possible settlements.

If you're thinking of opening up an offshore checking account, know the internal revenue service policies and also guidelines. You may require to check here file both the Fin, CEN kind 114, FBAR as well as the FATCA kind if you qualify. The IRS offers a detailed contrast table of the FATCA as well as Fin, CEN guidelines, so you can identify if as well as what you need to report.

Opening Offshore Bank Account Things To Know Before You Get This

In the declarations, they'll examine your purchases and want to see that you have a great record with dig this your financial institution. The financial institution may also inquire regarding what you intend to make use of the represent. This might seem invasive, however there has been increased international stress to prevent prohibited activity.

Holding funds in various currencies can come with repercussions. If you earn passion on down payments in a foreign money, you can develop international tax obligation liabilities. If you're constantly transferring and also withdrawing in various money, you might be hit with exchange price upcharges. Remember, this is how overseas financial institutions commonly make their cash, so be certain to investigate the charge structure and also upcharges of any type of possible overseas financial institution.

The Best Strategy To Use For Opening Offshore Bank Account

While it's basic to make the transferusually simply a point as well as click your computeraccount over at this website holders are often based on worldwide cable transfer charges when sending out as well as obtaining funds. While transferring money may have few opportunities, withdrawing your money is an additional tale. Offshore banks offer a plethora of methods to withdraw your funds as a method of developing ease for consumers.

This is an additional element you'll require to study, as costs tied to using the card can add up promptly. If you're going to utilize an atm machine, it's best to withdraw large amounts of money at the same time to decrease the fees. You might be able to get checks from the overseas bank, but it's usually not liked as the checks might not be approved locally.

Doing points this method enables you to have more safety and ease with access to your local bank. If you're searching for a debit card where you can spend money without foreign transaction costs, a Wise debit card is a strong alternative. With your Wise card, you can hold over 50 money free of cost as well as send cash right from your equilibriums.

Opening Offshore Bank Account Fundamentals Explained

Beginning receiving money from throughout the globe free of cost as well as transform to the currency you require with Wise - opening offshore bank account. Yes. It is lawful to have an overseas savings account so long as you follow the regulations, rules, as well as guidelines of both the United States government and overseas territories of the account.

The very same puts on an offshore business, it's a business operating outside the jurisdiction of its head office. Neither of these practices are prohibited for United States residents (opening offshore bank account). There is no simple response whether offshore bank accounts are secure or not. What we can recommend is that you utilize resources available to do your due diligence prior to putting cash right into any kind of foreign bank account or financial investment.